Current State of Cannabis Legalization

One of the fastest ways to the full legalization of cannabis is for states to individually allow for recreational and medical usage by citizens. It’s unlikely that the federal government will choose to legalize cannabis nationally, as a majority of leadership has openly stated they have no intention to do so.

A wealth of states have already implemented cannabis legalization through voter-based decisions. At the time of writing, 36 states (including the District of Columbia, Guam, Puerto Rico, and the US Virgin Islands) have legalized medical cannabis. Eighteen of those have further allowed for recreational cannabis sales and usage.

Beyond those, a wealth of states, including Texas, North Carolina, Mississippi, and more have CBD and low THC programs available. According to NCSL, only three states have no cannabis program (Kansas, Idaho, and Nebraska).

Despite this, the federal government and law enforcement still consider cannabis a Schedule 1 substance. This means that the US government believes that cannabis is considered to have a high potential risk for dependency and no accepted medical use…

There are almost half a million scientific papers listed on the Google Scholar search engine focused on the medical use of cannabis. It’s the huge array of scientific evidence supporting the medical and recreational use of cannabis that proponents of legalization lean on in their decision-making. Cannabis is legal for most Americans, but that doesn’t mean it is currently integrated efficiently into state economies.

While there is significant back and forth on the federal legalization of cannabis, those markets where cannabis is widely available have to deal with a wealth of issues related to payments and banking in cannabis. Right now, there are myriad problems with the ways that cannabis is bought and sold around the US.

That’s where the SAFE Banking Act comes into play…

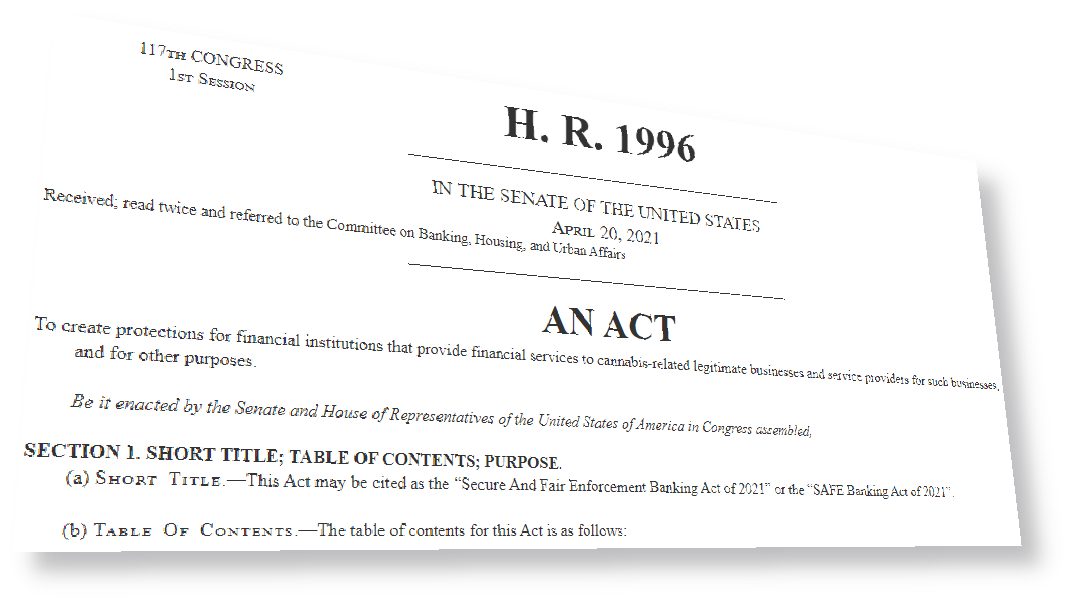

SAFE Banking Act

As a cannabis business owner, you’ve probably heard of the SAFE Banking Act (Secure And Fair Enforcement). If you haven’t, you really need to understand how this federal bill can have a positive impact on your business. We guarantee that by the time you’re done reading this article, you’ll be calling your local representatives to ask them to lobby for this legislation.

Put simply, the SAFE Banking Act prohibits federal banking regulators from “penalizing depository institutions for providing banking services to a legitimate cannabis-related business.” If passed, the SAFE Banking Act would open up regular banking processes to the cannabis industry. The banks would not be penalized by the government for offering financial services to cannabis businesses, including loans, insurance, and other such processes applicable to non-cannabis businesses.

History and Development of the Act

Various versions of the SAFE Banking Act have been introduced to Congress since 2017. The first introduction came in 2019 under the sponsorship of Sen. Jeff Merkley (D-OR) and Rep. Ed Perlmutter (D-CO). The basis of Perlmutter’s argument for the passage of the SAFE Banking Act is that 97.7 percent of the US population live in a state where cannabis is legally available in some way, shape, or form.

Because banks are prohibited from doing business with anyone in the cannabis industry, there is a significant risk to all those who work within or run a cannabis business. Politicians and legislators argue that cannabis businesses are frequently targeted by violent criminals.

The more than 300,000 people legally employed in the cannabis industry are perpetually at risk from robberies, theft, burglaries, and other violent crime. A majority of this risk comes from the huge volumes of cash that flow into dispensaries, grow operations, and other cannabis-related businesses.

Legislators also note that the SAFE Banking Act would provide massive cash injections to legal states. Untold billions of dollars flow through every vein of the cannabis industry on an annual basis, none of which can legally enter the federal banking system.

Where is the SAFE Act Now?

The SAFE Banking Act is currently passed by the House. Don’t get too excited though. According to Investopedia, various versions of the SAFE Banking Act have passed through the House since 2017.

On April 19th, 2021, the latest version of the Act passed through the House by a vote of 321 to 101. Though this Act is essentially the same as the one also passed in 2019, it comes at a time when America’s economy struggles through the negative effects of the COVID-19 pandemic. Some new additions to the language of the Act included protections for hemp businesses and expanded the definition of “financial services.”

The next step is for the act to pass through the Senate, to the President, and then to become law. In the meantime, if any banking or financial institution provides banking services to cannabis businesses, they are technically “aiding and abetting” in a federal crime.

Current Issues with Cannabis Banking

If you Google “cannabis banking,” you’ll drown in the results from start-ups, small banks, and self-proclaimed “experts” in legitimate cannabis banking. The truth is that anyone offering financial support to the cannabis industry is doing so illegally under federal law.

You might be asking yourself, “Well, I use my credit or debit card when I buy cannabis, so surely some banks exist to support cannabis banking?”

No. They don’t. The business you’re buying your weed from is technically breaking the law.

Dispensaries Accepting Card Transactions

Some of the biggest dispensary chains in the country allow customers to buy cannabis with their debit cards (and some credit cards). Forbes detailed a story of a man buying cannabis from a dispensary in Las Vegas with his debit card.

He was told by the budtender that he could use his card, but the dispensary would have to round up the nearest $10 denomination. The customer then received the balance as cash.

This is called the “cashless ATM” process that many cannabis businesses use to skirt around the practical issues of not being able to sell cannabis products by card transaction. Visa has issued statements claiming that the cashless ATM method disguises cannabis sales as an ATM withdrawal.

While there are other card-based processes for buying and selling cannabis, cashless ATMs are arguably the most popular and the riskiest. Let’s dig into the biggest issues with cashless ATMs that are largely ignored by cannabis business owners…

PCI Compliance

Payment card industry (PCI) compliance is a mandatory process used by credit card companies that help to ensure the security of credit card transactions in the payments industry (Investopedia). In layman’s terms, PCI compliance ensures that your data and information are protected when you make a payment using your card.

So, every time you use your debit or credit card in a dispensary that doesn’t attempt to ensure some form of PCI compliance, you’re putting all of your data at significant risk of cyberattack.

Ransomware & Cyberattacks

Ransomware and cyberattacks in the cannabis industry are the next big risk facing business owners and buyers alike. According to the Harvard Business Review, ransomware attacks have increased 150 percent since the start of the COVID-19 pandemic. Victims of attacks rose upwards of 300 percent. These are just some of the examples of why cannabis security in the digital realm is so important.

Polling conducted by MJBizDaily in 2021 found that 59 percent of cannabis businesses had not taken any significant steps (discussed below) to protect their companies from ransomware and cyber attacks.

So, what happens when you’re attacked by cybercriminals?

Usually, malware enters computing systems through a standard phishing email. When an employee clicks on a link, the cybercriminals gain access to all data and information contained with the system. Oftentimes, businesses are locked out of their data. In these situations, cybercriminals typically ask for cryptocurrency in exchange for the data and system usage they’ve stolen. This is the best-case scenario.

Sometimes, cybercriminals will retain all data and information they’ve stolen. In these situations, they’re able to sell the information online to the highest bidder.

Imagine your entire clientele list, internal operations, every single item of data held on your computing system being available to cybercriminals. Remember, your business also holds hugely personal and financial data for your customers and patients… Do you really think you’d be able to stay in business if a perfectly preventable breach like this were to happen?

Future-Proofing Security in the Cannabis Business

Even though you can’t technically use traditional financial systems to manage your cannabis business, you can still become PCI compliant in the lead-up to the passage of the SAFE Banking Act.

Firewalls

You can’t just use any old software to make your cannabis business PCI compliant. The firewalls needed to meet with PCI compliance are stringent. Here at Woodrow Technologies, we’ve cultivated our expertise in PCI compliance as the leading third-party information technology company with a mission to secure the cannabis industry from cybercriminals.

Building Point-of-Sale Compliance

Modernizing your point-of-sale (POS) compliance requires regular updates and testing. Very few people have the skills to accurately and consistently ensure that POS systems are operating at their highest level of security. When the POS compliance involves cannabis, the stakes are higher. Layering in mobile marijuana and delivery security adds even more complexity. You truly need an expert that has comprehensive knowledge and experience in cannabis regulations and security requirements in your specific state to ensure your practices are compliant from seed to sale.

Why Use Woodrow Technologies for Cannabis Security?

When it comes down to it, your cannabis business almost certainly isn’t as secure as you think it is. All of the data in your dispensary is at risk of cyberattack.

Hackers and cybercriminals are only going to ramp up their attacks before the passage of the SAFE Banking Act.

As soon as the SAFE Banking Act passes, cannabis businesses are going to be heavily scrutinized before being able to process card transactions.

Wouldn’t you prefer to be PCI compliant and safe right now? Well, you can be.

Creating Best Practices

Here at Woodrow Technologies, we’ve made it our mission to protect your business now and into the future.

Our packages include all monthly services and hardware, so you’ll be saving money while securing your cannabis.

Get in touch with us today so we can build our customizable package to protect your business.

If you still have questions, we can answer them all.